Deal volume is down but deal value is up

By Heather Hopkins | 30 April 2025 | 3 minute read

Deal volume is down but deal value is up. That was one of the main conclusions from our research on consolidation and aggregation of UK financial advice firms. In 2024, we tracked 127 publicly announced deals compared to 134 in 2023.

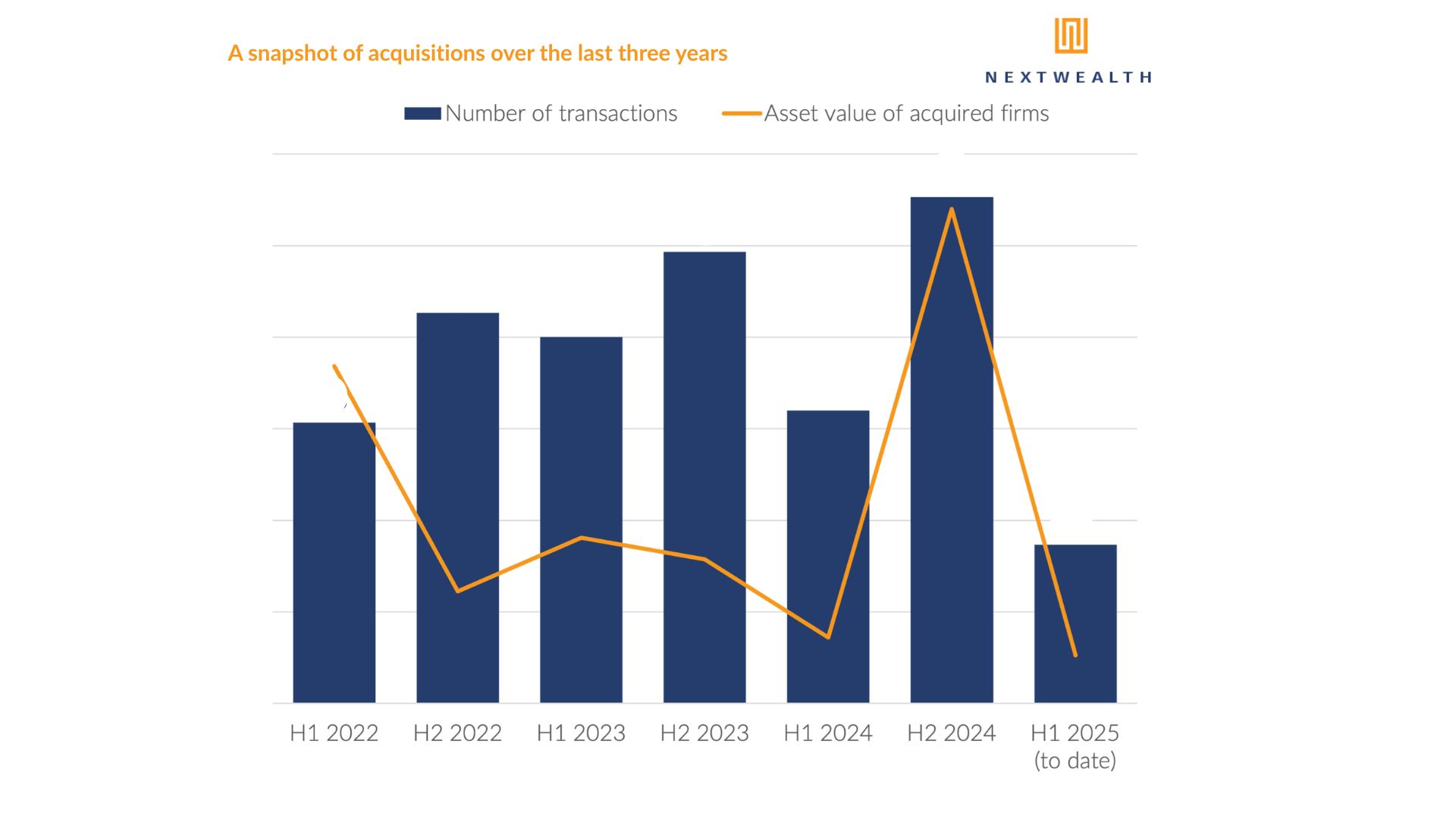

As a research geek, I like to think a chart can tell a thousand words. This is one of my favourites.

The chart shows the number of deals on a half yearly basis from 2022 to present. Note the massive upswing in deal value in H2 2024.

And the volume (and value) does not seem to be slowing down. Here’s a list of just a few of the deals this year:

- Corbel Partners bought seven firms in Q1

- Soderberg continues to invest in firms, taking a stake in Murphy Wealth

- Benchmark bought the remaining minority stake in Oculus, consolidation of networks

All of this activity is leading to some big shifts in our industry. A growing cohort of financial advice firm acquirers are vertically integrated. Among the 25 acquirers profiled in our Consolidators and Aggregators report:

- 84% offer portfolio management services

- 68% manage their own funds

- 56% have a platform

If these firms keep snapping up financial advice firms, their influence over asset flows will grow and that will re-write the way that asset managers, platforms, DFMs and tech firms need to work with them.

What to look out for next?

- MPS providers:

Which firms are gathering assets fastest? DFMs with an advice arm or independent DFMs?

You can find out in our June update on discretionary MPS.

“About 50% of client asset flows don’t go into our CIP and so we are working on improving that offering for our clients.”

– Large acquiring financial advice firm with a DFM

- Data openness:

Which providers give the best access to the data that consolidators need?

We are increasingly hearing that consolidators are actively moving assets away from providers that don’t share the client-level and firm-level data they need. We think data openness is an important way that platforms and pension product providers can differentiate, and we will look at this in detail in a report on this theme in July.

“We want to move to a true ongoing service and get away from the annual review cycle. But to do that we need the data. If it takes us 6 weeks to 3 months to get data together for a review, we need to plan for that in advance. We should be able to get all the data we need for a client review every day. We’re working with platforms and other providers to get to that point.”

– Large acquiring financial advice firm

At NextWealth, we help our clients adapt, innovate and thrive amid disruption. To find out more about our research and events programme, get in touch.

Heather Hopkins