AI Lab key takeaways and case studies of AI leading to efficiency gains in wealth management firms

By Heather Hopkins | 05 June 2024 | 4 minute read

Last month we were delighted to host the inaugural AI Lab event, a quarterly meet-up to share ideas and AI use cases in wealth management firms. As artificial intelligence continues to evolve rapidly and the rate of adoption in wealth management accelerates, we were pleased to bring together leaders and thinkers to explore how AI can reshape our industry.

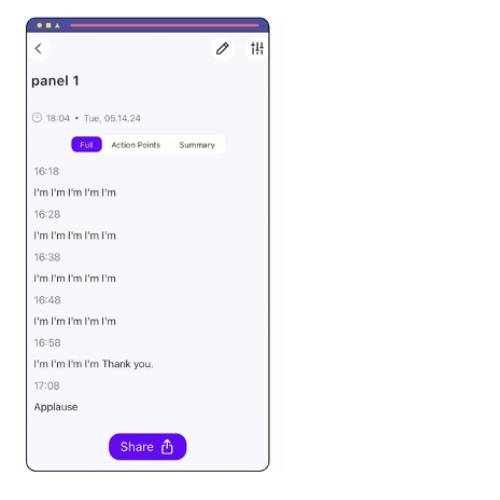

We asked the robot to summarise the conversation. Sadly, it didn’t seem to make much of our first panel.

Happily, we had a human back-up and we’re happy to share some of the key takeaways.

>> If you want to come to our quarterly meet-ups, get in touch for membership options. >>

Why AI Lab?

The following quotes, from our interviews with C-suite executives at financial advice firms, summarise why we launched AI Lab and why this is important.

“People should be so excited to meet us. But as an industry that’s the not badge we wear at the moment. When someone leaves the office after meeting one of our advisers – wow they are really engaged. But then they wait weeks for any action – they lose all that excitement. Could AI help us to keep our customers excited and to make those coming to us excited to meet us?”

“What is the purpose of the wealth management industry. The purpose has got to be to ensure everyone has access to good professional financial planning and money management at a price they can afford and that helps them achieve their financial goals through life. What if we could do that for everybody? … If the purpose is a wider purpose – societal and commercial – if you could do that and have at our disposable technologies that were unthinkable just ten years ago, why wouldn’t we do that and make that leap.”

Wouldn’t it be great to use tech to improve client experience and reach a wider audience?

In our event and subsequent report, we heard about the rapid rise in adoption of AI solutions in financial advice firms. Two thirds of respondents to our survey say they are using AI in their financial advice firm today. AI will help widen access beyond the 8% of the UK population that currently pay for advice. It will improve client journeys and importantly, it will bring back the fun! AI can take over repetitive, error-prone tasks, freeing up advisers to focus on the more fulfilling aspects of their job. This not only improves job satisfaction but also enhances service quality.

Real-World Success Stories

Our AI Lab event showcased some fascinating case studies:

1. Data integration in acquisitions

- One consolidator is leveraging AI to clean and structure data from acquired firms, making integration faster and more efficient.

2. Extracting data from PDFs

- Intuitive Support has implemented an AI tool that reduces the time needed to extract data from provider PDFs from 30 minutes to just 3 minutes, significantly boosting efficiency.

- We also heard from a platform that is extracting data on corporate actions, reducing processing time and errors.

3. MiFID cost and charges reports

- A large consolidator uses an AI engine to process these reports, saving thousands of hours in administrative time annually.

Looking ahead

In our survey of financial advice professionals before the event, we asked about challenges related to AI. FOMO (fear of missing out) came out top. FOMO is real, but don’t worry – we’re here to guide you through these innovations, helping you leverage the best tools to enhance your business.

AI Lab will meet again in September. Alastair Walker, my co-chair for the event and Chartered Financial Planner at HA&W, and I are already coming up with ideas for the agenda. AI Lab members will get free access to the events and our AI Index tracking adoption and readiness to adopt AI in financial advice businesses.

Find out more and join our growing AI Labs community.

Heather (with much assistance from our friendly robot, Chat GPT)