Two steps back; four steps forward

By Julie Best | 16 October 2024 | 4 minute read

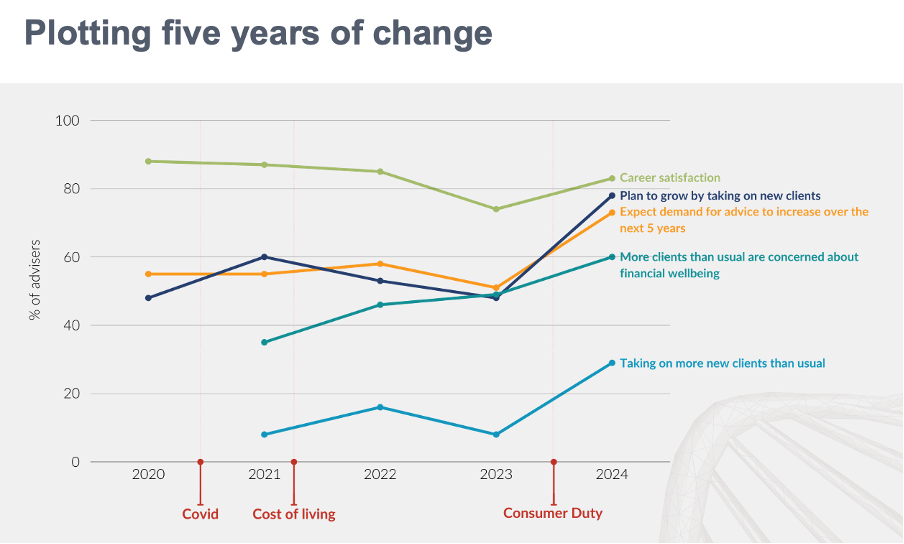

Five-year trend data for our IFA DNA project with Fidelity show financial advice firms have been trimming their sails to catch the next tailwinds

Left to its own devices, a boat’s sail will flap around in the wind like a flag. As well as being noisy and looking amateurish out on the water, it’s also inefficient and potentially even damaging, so I’m told. Hence to make a sailing boat move forward with power, the sails are ‘trimmed’ – their shape and position are adjusted in relation to the wind.

We presented the latest findings of our IFA DNA research this week, to the team at Fidelity who have supported this project since 2020, and a gathering of journalists and financial advisers. It’s a milestone year, marking the fifth iteration of this report[1], which you can read in full here.

Having such continuity on a project is wonderful because we can build the data over a consistent period and step back to look for patterns. We have pulled out five of the key data points covered in IFA DNA to paint a picture of what financial advice firms have experienced over the last five years.

[1] To be precise, it’s the sixth iteration because the Fidelity team were keen to check-in with advice firms mid-COVID

Overall, as the chart shows, it’s a strong picture of growth and optimism. Last year though was a notable dip in most of these metrics. Clients and financial advisers alike were feeling the cost-of-living crisis bite, markets were showing little growth and everyone was feeling the pressure of meeting new regulatory requirements for the Consumer Duty.

This year, we see a surge forward in financial advisers’ growth plans, in the expected future demand for advice and in the number of new clients that advisers are servicing year-on-year.

We had our own narrative prepared, but as is so often the case, in a chat over coffee before the event, a financial advice business owner landed the perfect description. He told me that his firm has deliberately taken two steps back, in order to take four steps forward. They’ve been trimming the sails – reviewing their client bank, their proposition and the way they deliver and charge for their services. Indeed, our research backs that up. 83% of respondents to our IFA DNA survey this year have made, are making or plan to make changes to their fees and charging structures as a result of the Consumer Duty.

Large numbers of advice firms have done a similar exercise with their investment propositions, their client propositions, their processes, practices and tools.

And now they’re ready to take advantage of the opportunities ahead. One of the financial advisers interviewed in depth for this report described the “two tailwinds of decumulation and intergenerational wealth transfer” from which the industry will benefit in the coming years.

We included two more very important data points on this summary chart. Career satisfaction is high and sustained. Last year the frustration and pressure took its toll, but more than 80% of financial advisers continue to derive enormous satisfaction from the job.

Clients are feeling the pinch too, and financial advisers (60% this year) report that more of their clients than usual are concerned about their financial wellbeing. These are anxious times, but we think that trend is also indicative of the type of the deeper and more personal conversations that financial advisers are increasingly having with their clients. “Gone are the days where you’d talk about how the Yen has performed against the Dollar”, said one interviewee.

All of this is not to say there aren’t also significant headwinds for the financial advice industry. There’s no plain sailing on the horizon. But that’s when financial advisers have the most input to make. Left to their own devices, in turbulent and unpredictable times, clients would be feeling significantly more battered by the winds of uncertainty.

Julie Best, Qualitative Researcher