To PE or not to PE, that is the question

By Alex Johnson | 23 April 2025 | 2 minute read

In our newly released 2025 Consolidators & Aggregators Report, one of the topics we explore is the evolving role of private equity in driving the growth of financial advice firms through acquisition. It’s a hot topic and one that is shaping the future of the sector, and the path is not always clear-cut.

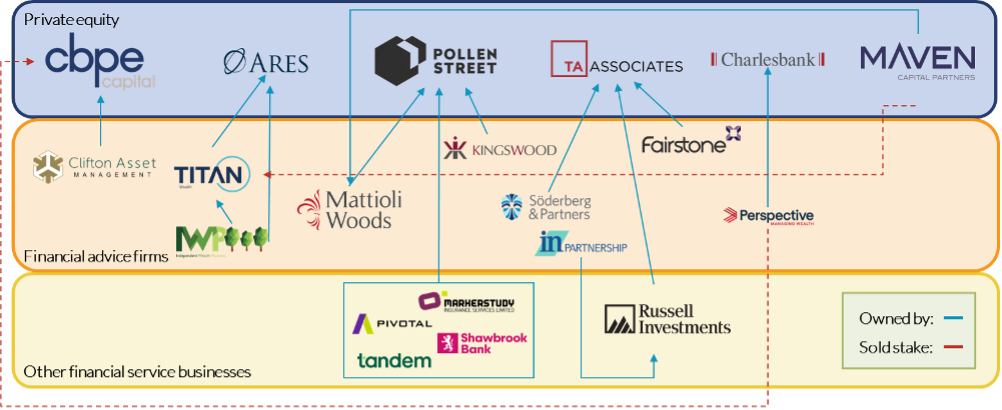

A snapshot of private equity ownership in financial services

Private equity ownership is a tangled web of relationships, as shown in the illustration. In 2024, we saw 48 unique financial advice firms make acquisitions, and two thirds of those firms are backed by private equity. The picture becomes even more layered when you factor in that several private equity providers also offer private credit facilities to advice firms. Sentiment around private equity remains mixed, as do the outcomes for acquired businesses. For a success story, look no further than Perspective – the most acquisitive financial advice firm by number of deals. Perspective received funding from CBPE in 2019 to pursue an aggressive acquisition strategy, which saw the firm quadruple in size over the five-year partnership. CBPE sold the business to Charlesbank at the beginning of 2024, but the acquisition drive appears unfettered, with nine deals already completed in 2025.

While success can is subjective, Perspective has proven that it can deploy PE capital to make a consistent and large number of annual acquisitions and integrate them in a timely fashion to add value to the business and the underlying client.

On the flip side, consider Independent Wealth Planners (IWP), a firm that went on an acquisition spree in 2020–2021 funded by credit from minority stakeholders Ares Management and Gresham House. IWP did not properly integrate its strong pipeline of acquisitions which resulted in the firm being unable to realise the potential of those acquisitions or service the associated debt. IWP entered several years of limbo before culminating in its acquisition by Titan Wealth at the end of 2024.

So, where does that leave us? We are optimistic on the future of private equity in UK financial services. While there will still be the occasional growing pain, financial advice firms and their PE partners seem to be finding their stride. PE firms are better understanding financial advice and the associated regulation with the focus shifting towards long-term transformation and professionalisation rather than just revenue.

Looking forward, firms will continue to consolidate and consolidators will continue to change hands between private equity firms, but the playbook for success is now far clearer. We expect some bold moves in 2025.

Alex Johnson, Head of Data