Consolidation: Beyond the deal

By Emma Napier | 06 May 2025 | 2 minute read

Years ago, I was part of the team at Advisory & Brokerage Services, which was acquired by Aegon along with four other advice businesses, eventually creating a new firm under one roof – Origen.

Each of the five firms brought its own identity, systems, and way of working. Every business wanted to lead the charge and be the benchmark for the new Origen brand.

Decisions on tech, processes, platforms and investment propositions were only part of the story. We set about building trust, redefining roles, and, of course, supporting advisers and clients through ambiguity. It took years – not months.

With that in mind. Let’s turn to the market today.

In the early waves of consolidation, focus was often on the deal itself – speed, scale and synergy wins. In some cases, a rushed-through integration led to cultural mismatch, adviser attrition and operational headaches down the line.

That’s changing.

Consolidation today is slower, deeper and still accelerating.

In our third annual NextWealth Consolidators & Aggregators Report, we track more than 500 acquisitions from Q1 2021 to Q1 2025 and profile 25 acquirers in detail. The findings confirm:

- The pace of acquisitions has slowed slightly, but the value of deals has grown

- Deal multiples have doubled, now reaching 6–12x EBITDA — a clear signal that demand remains high

- Private equity remains deeply invested, with more than 30 PE firms involved and eyeing exits or roll-ups – the so-called “consolidation of consolidators.”

What does all that mean for everyone else?

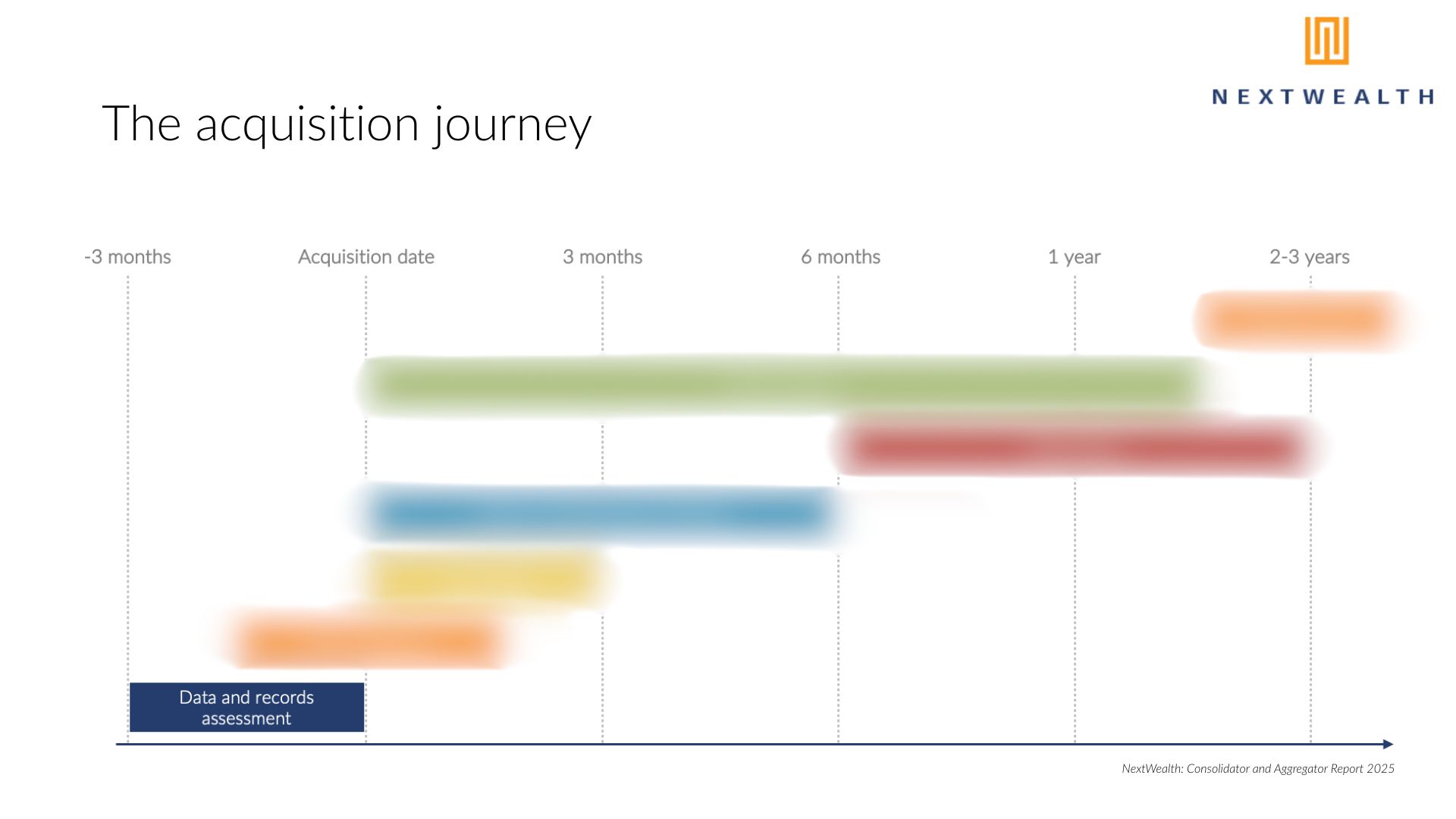

This year, we asked acquirers about process and timeline. What does integration really look like?

It starts with data and relies heavily on project management – adviser onboarding, novation, and rebranding. But it doesn’t stop there.

For providers of investment solutions, platforms, back office and tech solutions, this report goes beyond the deal with a stark reality that successful consolidation takes time.

Find your window, plan your move to reinforce your brand, your value, demonstrate support and secure long-term partnerships.

A few tips for providers

- Engage early and often with consolidators and their acquisition targets.

- Invest in service infrastructure to ease transitions and minimise adviser frustration.

- Position your offer to align with evolving CIP and tech strategies.

- Highlight flexibility, integration, and partnership, not just product or performance.

The NextWealth Consolidators & Aggregators Report 2025 offers in-depth insight into who’s buying, how they’re integrating, and what it means for the rest of the retail wealth landscape.

👉 enquiries@nextwealth.co.uk

Emma Napier, Consulting Director at NextWealth