Concentrated asset growth is changing the shape of the MPS market

By Mark Aldous | 17 December 2024 | 2 minute read

Our MPS Proposition Comparison Report, published a couple of weeks ago, revealed that assets in MPS had grown 36% in the 12 months up to the end of Q3 2024 however, the report found that this growth is uneven and changing the shape of the market.

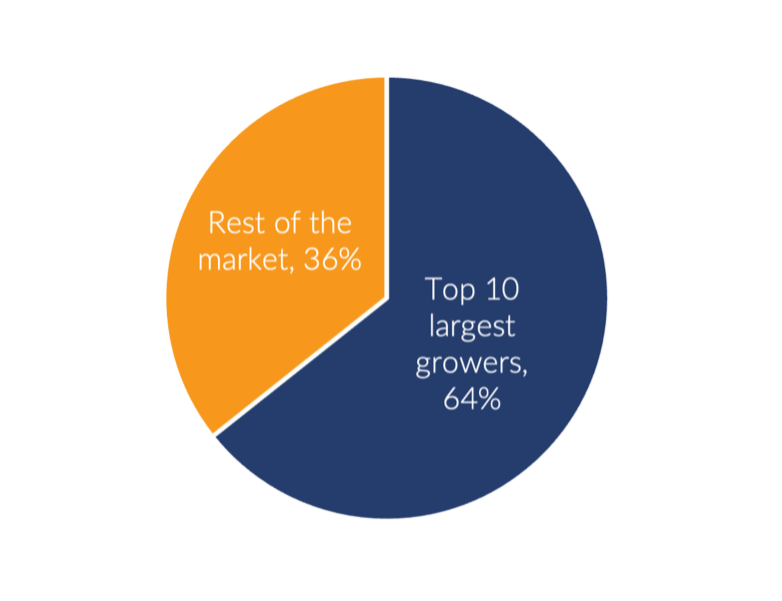

Nearly two thirds of all net asset growth in the past 12 months was added by just 10 firms. The pie chart in figure 1 shows that 64% of net asset growth went to the 10 largest growing firms, the rest of the market’s growth is spread across 30 firms (all DFMs ranked outside the top 10 by net asset growth). The growth is creating a few dominant providers in the market, you can read in full about the sources and impacts of the growth in MPS assets in the report.

Figure 1: Net asset growth is dominated by 10 DFMs

To find out more about who the largest growers are, how the market is changing shape and the headwinds and tailwinds for growth in DFM assets contact enquiries@nextwealth.co.uk to purchase your copy of the report. The report also addresses the future for growth in MPS, effects of capital gains tax on MPS flows along with pricing analysis and the changing allocation to passive in MPS.

The results presented in this report are based on data requests from DFMs, interviews with representatives of those firms, surveys of financial advice professionals and our knowledge and expertise of the UK financial advice and platform market.

- Interviews with 30 representatives of DFMs operating MPS on platform.

- Data requests completed by 52 DFMs. Data is as at 30th September 2024.

- Pricing analysis was conducted across 405 portfolios from those DFMs.

Survey of 340 financial advice professionals, conducted in June and July 2024.