Centralised decision making and the shift in product choice

By Heather Hopkins | 01 November 2024 | 2 minute read

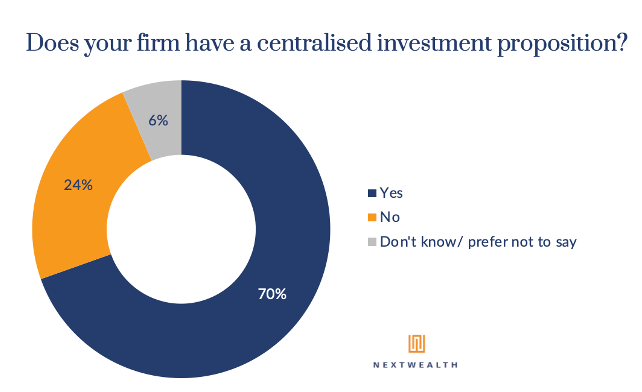

In our Financial Advice Business Benchmarks report, we found that 70% of financial advice professionals work in a firm with a centralised investment proposition (CIP). Employees of growth firms are even more likely to say their firm has a CIP.

Three reasons I think there will be a continued shift to centralised investment decision-making.

- Centralised decision-making is present in financial advice firms, has bled into wealth management and is bleeding into private client businesses as well. It is getting harder for firms to tolerate advisers or wealth managers making investment decisions for individual clients in regional offices. Recommendations can be personalised from a curated array of offerings. Going off panel is getting harder.

- Conversations with clients have evolved. Adviser-client conversations don’t tend to centre on product. As an adviser told us in a recent set of interviews for Fidelity’s IFA DNA project, “gone are the days where an adviser would sit there and say right, ‘let’s talk about how the Yen’s performed against the US Dollar.”

- Regulatory intervention has led firms to exert more central control to ensure consistency of proposition. Senior managers are on the hook for advice delivered in regional offices. There’s only so much

Concentration to a central decision-making epicentre will continue to grow. This has and will continue to drive a shift in the products that financial advisers and wealth managers consume from asset managers.

Discretionary MPS is a perfect example of this. Centralised decision-making, cost pressure and the need for consistency has fuelled the rapid rise of discretionary MPS and investment solutions.

Will we see a massive shift to unitised versions of MPS and is this a back to the future moment with a return to fund of funds? This week’s budget will shed light on this. For the answer, you will want to read our forthcoming report on discretionary MPS. Get in touch to find out more.

Heather